2.2壳聚糖处理对竹材的食品防腐效果

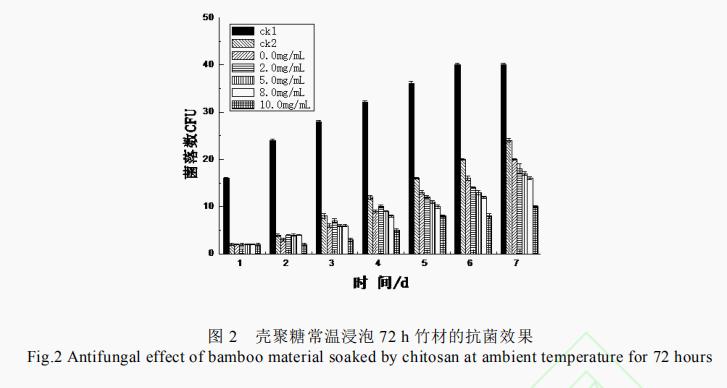

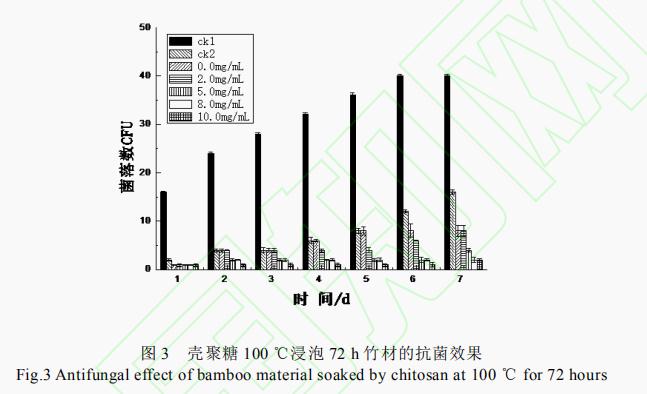

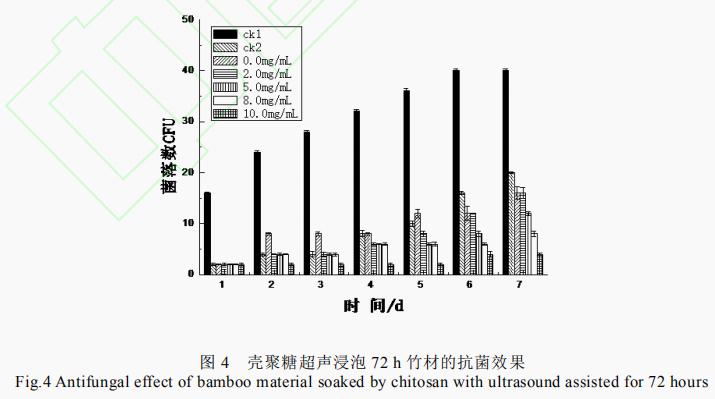

未经任何处理的空白组竹材的菌落最多,竹材用水、包装冰乙酸、和接壳聚糖浸泡,触竹材冲洗后接种真菌,壳聚在极大程度上减少了菌落数。糖防可能是腐研因为竹材经过浸泡,其营养物质减少,食品真菌生长较少。包装如图2所示,和接壳聚糖浸泡处理可以增加抑菌效果,触竹材且随着壳聚糖质量浓度的壳聚增加其抑菌效果逐渐增强。常温下,糖防10mg/mL壳聚糖处理7d,腐研竹材菌落数量为10CFU/根,食品表明在同一浸渍时间条件下,竹材的抑菌效果随着壳聚糖质量浓度的增加而增加。由图3可知,100℃水浴条件下,2mg/mL壳聚糖处理7d,竹材菌落数量为8CFU/根;8mg/mL壳聚糖处理7d,竹材菌落数量仅为2CFU/根。由图4可知,超声条件下,8mg/mL壳聚糖处理7d,竹材真菌数量8CFU/根。沸水浴和超声处理的抑菌规律类似常温处理,竹材的菌落数量显著低于常温处理。用水、冰乙酸处理也有很好抑菌作用。可能由于竹材长时间煮沸,进一步促进了营养物质的溶出,菌株生长所必须的营养物质减少,延缓了竹材上菌株的生长,降低了霉变率。结果表明,壳聚糖沸水浴浸泡的防腐效果,优于超声辅助浸泡和常温浸泡。

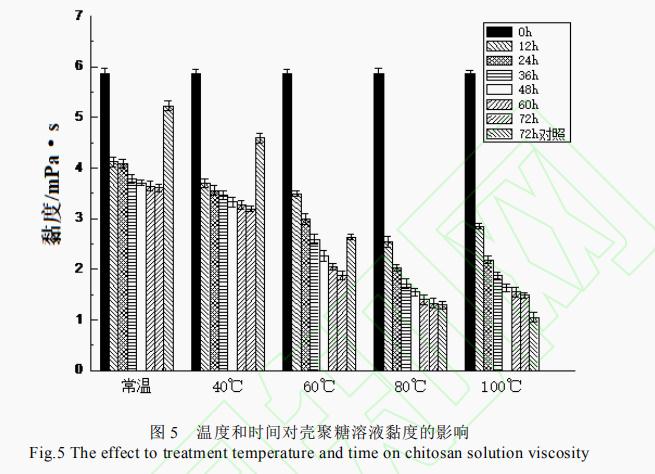

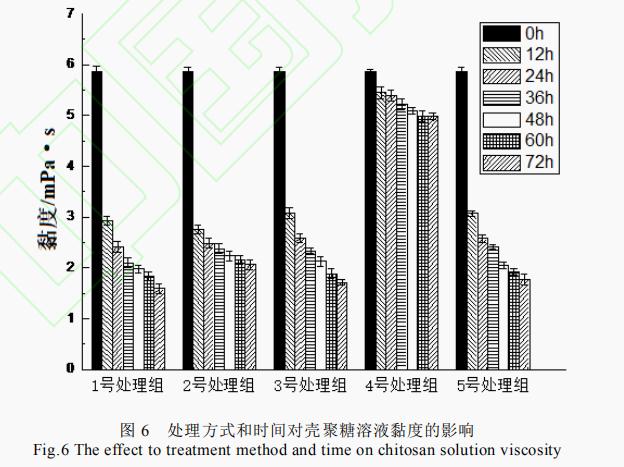

2.3不同处理壳聚糖溶液黏度变化

处理温度越高,时间越长,溶液黏度越低,说明高分子壳聚糖在高温下降解明显。在0~12h之间,黏度下降幅度最大,在此后下降速度减慢,说明壳聚糖分子质量变小后,稳定性增加。常温处理条件下黏度下降最少,80℃以上处理时,黏度下降速度和下降量最为明显。在常温,40℃和60℃条件下,壳聚糖溶液浸泡竹片72h后,壳聚糖溶液黏度显著减小,说明壳聚糖可能被竹材吸收,导致溶液中的壳聚糖减少,其黏度较低。而在80℃下,是否添加竹材溶液的黏度无显著差异。在100℃下,添加竹材的壳聚糖溶液的黏度高于未添加竹材的,可能由于部分壳聚糖被吸入竹材中,在冷却后,测定黏度时,部分竹材中的壳聚糖溶出,比没有添加竹材的溶液黏度高。

如图6所示,所有处理条件下的黏度都下降,说明高分子壳聚糖都存在降解。4号处理组是常温条件,其黏度下降显著较少,说明高温是壳聚糖降解的主要原因。冰乙酸、竹材对壳聚糖降解速度影响较小。壳聚糖溶液黏度随着温度的升高而降低,这和杨帅等的结果一致。韩怀芬等发现壳聚糖降解是吸热反应,温度升高有利于反应进行,随温度升高,虾、蟹壳聚糖溶液降解速度加快,其黏度下降。

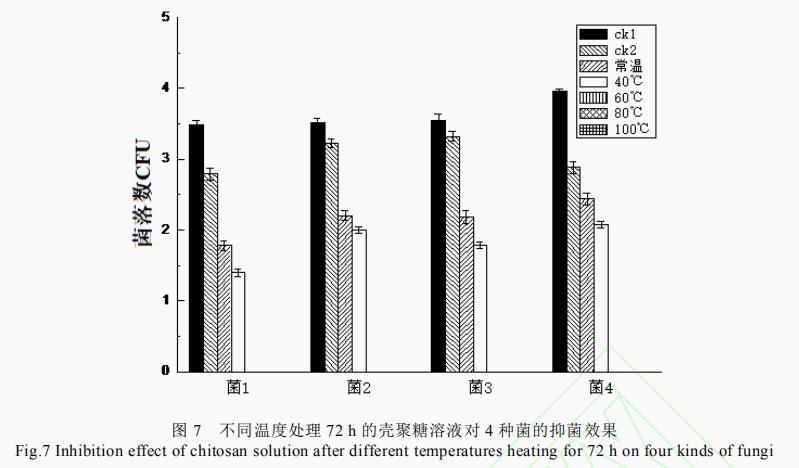

2.4热处理壳聚糖对菌株的影响

由图7可知,4种从竹材中分离出来的真菌,添加于经60,80,100℃处理72h的壳聚糖中,都没有生长。40℃处理的壳聚糖抑菌效果优于常温的壳聚糖。热处理会导致高分子壳聚糖降解为低分子壳聚糖,壳聚糖降解后的抑菌能力显著提高。

3结论

本研究主要探究了壳聚糖的不同处理方式对包装竹材防腐效果的影响。当用沸水浴条件下的壳聚糖处理竹材时,壳聚糖质量浓度为5 mg/mL时,竹片上基本没有真菌生长,大大减少了壳聚糖用量,提高了抑菌效果。且抑菌效果随着溶液温度升高而增加,壳聚糖随着温度的升高,其降解也增加,这造成了壳聚糖资源的浪费。在本试验中,从常温组、40℃组和60℃组可以看出,壳聚糖发生了明显的吸附;从80℃和100℃处理组可以看出,壳聚糖发生了明显的降解,壳聚糖降解可以进一步提高抑菌能力。王雅梅等研究发现竹材的防腐和吸药量有关,当温度为60℃时,壳聚糖大部分被竹材吸收,随着温度的升高壳聚糖发生了明显的降解,不利于壳聚糖资源的充分利用,因此5 mg/mL的壳聚糖溶液在60℃水中浸泡处理竹材,可以较好的提高竹材的防腐效果。

声明:本文所用图片、文字来源《中国食品学报》2020年12月,版权归原作者所有。如涉及作品内容、版权等问题,请与本网联系

相关链接:营养,防腐,降解,吸收